Hyperinflation of Currencies

James Turk recently raised an important question: are all currencies ultimately moving toward hyperinflation, and how likely is that outcome?

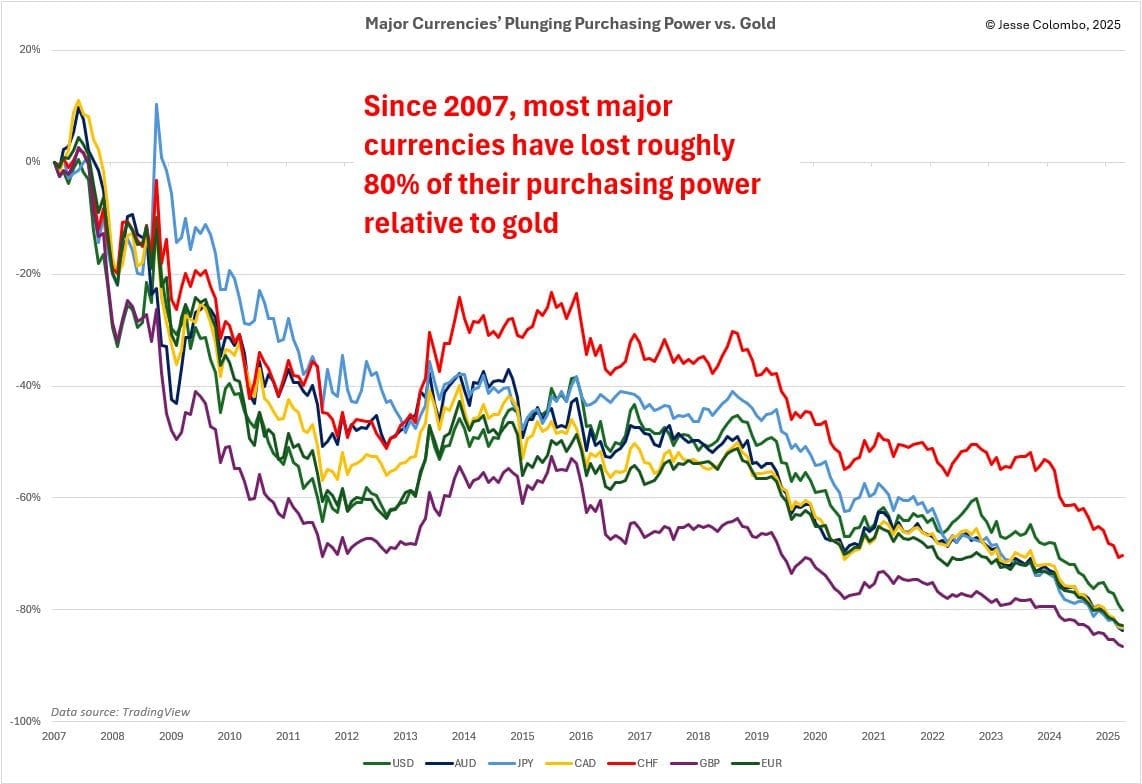

If the long-term charts are any indication, even so-called “strong” currencies may not remain strong for much longer. They may outperform weaker currencies for a time, but that depends entirely on the reference point. From that perspective, “relatively good” money is still not good money. It is merely less bad. I would rather step aside and hold something real.

An anonymous comment from FOFOA’s blog ties several of these ideas together:

“All modern digital currencies do not go into an investment; they move through it. Central banks do not hold currency—they hold bonds denominated in currency. The problem today is that digital accounting has erased national boundaries in debt markets. Currency assets are marked to market and cross-valued in real time. All currencies are effectively locked together. To lose one major currency is to lose the entire structure as we know it.”

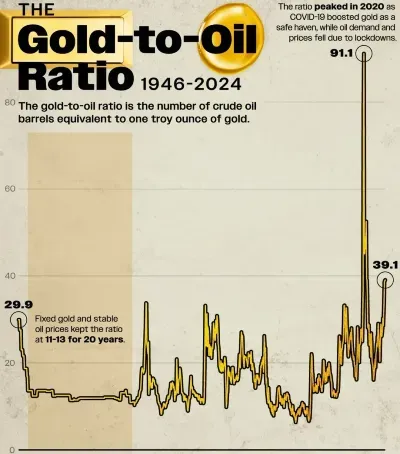

This captures the core issue: currencies are interconnected through the reserve system and through shared incentives to preserve the existing order. What we are witnessing is often described as a currency war—a race to debase. Each government seeks to weaken its currency to protect exports. The side effect is rising prices across the board, especially for necessities such as food and energy.

The question, then, is how long this process can continue.

That depends on supply and demand—specifically, inflation versus usage demand. Inflation begins to dominate when prices rise faster than people’s ability or willingness to pay. As price increases accelerate, either inflation is accelerating, demand is collapsing, or both. When essential goods consume the majority of household income, social stress rises quickly. This dynamic has played out repeatedly in history and is visible wherever food and energy costs surge faster than wages.

Yet inflation alone is not enough to end the system. As long as people continue to use the currency—voluntarily or through enforcement—there is demand. The system holds together until individuals, businesses, or nations begin settling trade in something else. That is when conditions change rapidly.

Another comment from FOFOA highlights the importance of oil:

“We are effectively on an oil standard. As long as oil is settled exclusively in dollars, the system survives—regardless of quantitative easing, inflation, or market crashes. Watch oil.”

Oil is central because it underpins the modern economy. As long as it remains easier—or necessary—to use the dollar for energy trade, demand for the dollar persists. When that changes, usage demand erodes quickly.

FOFOA once described the situation with a vivid metaphor:

We are spectators in a vast arena watching a clash among giants. These giants—nations and systems—have lived together uneasily for decades. They differ profoundly, and reconciliation is unlikely. What they share, however, is gold. And quietly, they continue to acquire more of it.

If the monetary system transitions to something new, there will be a period of exchange. In that transition, the question becomes simple: would you rather hold paper claims, subject to whatever exchange rate is imposed, or hold something outside the system that must be negotiated for?

Gold cannot be suppressed indefinitely. Its suppression today depends on the dollar’s reserve status. No other currency has sufficient reach to control a globally traded commodity. For a single global paper currency to replace the current system, it would require a level of trust and credibility that no issuing authority presently commands. A more likely outcome is a hybrid system in which gold functions as a confidence anchor.

Holding physical gold is not without risk. Anything physical can be taken. But paper and digital claims carry their own risk: if the system fails, they disappear entirely. Physical ownership carries danger—but also resilience. Risk management, discretion, and decentralization matter.

Whether or not one believes in grand narratives, the underlying conclusion remains unchanged. The system is strained. The structure is evolving. The wave is coming, regardless of whether one chooses to ride it.